Urban Farming

This function is exclusive for Premium subscribers

-

DATABASE (3)

-

ARTICLES (8)

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Agricool: Growing fresh strawberries in shipping containers

Paris-based Agricool grows fresh produce in urban aeroponics farms within shipping containers for sale at downtown supermarkets, aims to supply more large cities by 2030

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

Singrow to start selling Singapore-grown strawberries in March, plans $15m Series A this year

Singrow also plans to offer locally grown produce across Southeast Asia, starting with strawberries farmed in energy-efficient greenhouses

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

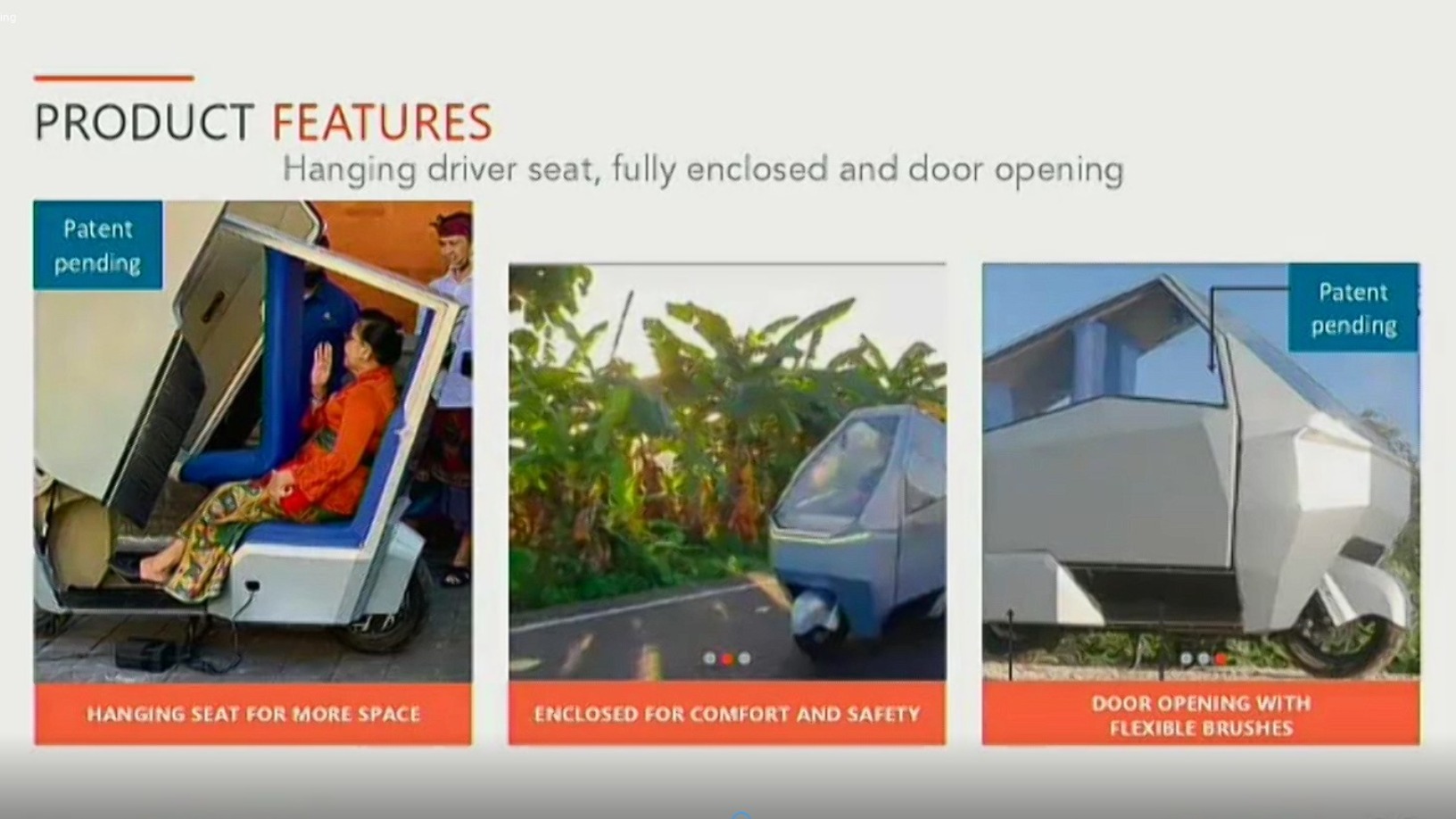

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Beyond billion dollar investment rounds, Indonesia and Singapore are working together to harness the potential of their startup ecosystems