Artificial Intelligence

This function is exclusive for Premium subscribers

-

DATABASE (222)

-

ARTICLES (267)

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

Zhongke Turing (CASTuring) was jointly set up by the Chinese Academy of Sciences’ Institution of Computing Technology, the Beijing Municipal Science & Technology Commission and private VC firms, including Pioneer Investment, in 2019. It provides seed funding and incubation services to businesses from emerging industries deemed as strategically important, including but not limited to chipmaking, artificial intelligence, the Internet of Things and big data.

Zhongke Turing (CASTuring) was jointly set up by the Chinese Academy of Sciences’ Institution of Computing Technology, the Beijing Municipal Science & Technology Commission and private VC firms, including Pioneer Investment, in 2019. It provides seed funding and incubation services to businesses from emerging industries deemed as strategically important, including but not limited to chipmaking, artificial intelligence, the Internet of Things and big data.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

Guangzhou Emerging Industry Development Fund

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

JUE Capital was founded by China’s famous angel investor Wang Gang who invested in quite a few high-profile startups including Didi Chuxing and Ofo. He is also the founding and managing partner of Envision Capital. According to Wang, JUE Capital focuses on the combination of Chinese traditional aesthetic with modern lifestyle.

JUE Capital was founded by China’s famous angel investor Wang Gang who invested in quite a few high-profile startups including Didi Chuxing and Ofo. He is also the founding and managing partner of Envision Capital. According to Wang, JUE Capital focuses on the combination of Chinese traditional aesthetic with modern lifestyle.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Founded in 2019 in Silicon Valley, Concrete Rose is focused on diversity by investing in under-represented founders and companies serving under-represented consumers at the early-stage and across market segments. It currently has 14 companies in its portfolio and its most recent investments in January 2021 include the $3.5m seed round of inclusive car insurer Loop and in the $17.1m seed round of HR analytics software Syndio

Founded in 2019 in Silicon Valley, Concrete Rose is focused on diversity by investing in under-represented founders and companies serving under-represented consumers at the early-stage and across market segments. It currently has 14 companies in its portfolio and its most recent investments in January 2021 include the $3.5m seed round of inclusive car insurer Loop and in the $17.1m seed round of HR analytics software Syndio

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

SWITCH Singapore 2021: How to harness the power of the deep tech ecosystem

Investor Jason Illian of Koch Disruptive Technologies talks talent, scaling for deep tech startups, and why longer gestation periods and mid-course pivots don’t have to be deal breakers

SWITCH Singapore 2021: Benefits and challenges of AI applications in healthcare

Medical experts and healthcare startups agree AI can contribute more to healthcare beyond improving diagnosis and personalized treatment, but hurdles still remain

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

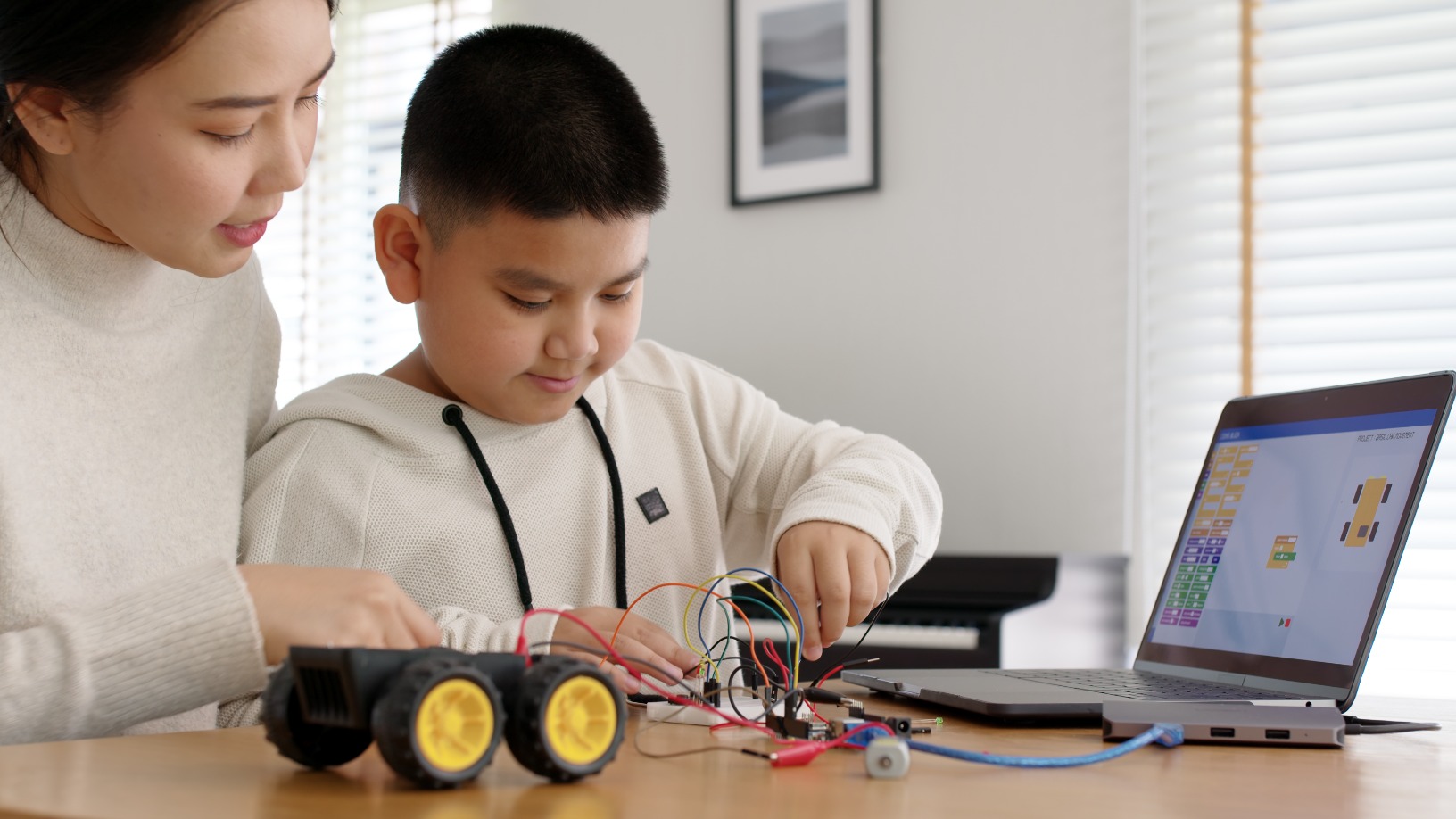

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

South Summit 2021: Key insights on going from startup to scaleup in Spain

Company culture, talent acquisition and ecosystem support are top-of-mind for Voicemod’s Jaime Bosch and Jobandtalent’s Juan Urdiales in scaling startups up from zero to hero

South Summit 2021: Martin Varavsky, Leandro Sigman on post-Covid healthcare trends

Serial entrepreneur Martin Varavsky and Insud Pharma Chairman Leandro Sigman share their thoughts and projections on the future of health tech

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Search instead for portugal, b2b, hospitality