SaaS

This function is exclusive for Premium subscribers

DATABASE (144)

ARTICLES (179)

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

Omnes is a Paris-based European investor in private equity and infrastructure. It specializes in deep tech and healthcare. It has backed 450 businesses, with €5bn assets under management.

Omnes is a Paris-based European investor in private equity and infrastructure. It specializes in deep tech and healthcare. It has backed 450 businesses, with €5bn assets under management.

Xange is the venture capital arm of Siparex Group, with offices in Paris and Munich. It is dedicated to supporting entrepreneurs in disruptive digital, deep tech and social impact. It has €450m under management and 65 startups in its portfolio.

Xange is the venture capital arm of Siparex Group, with offices in Paris and Munich. It is dedicated to supporting entrepreneurs in disruptive digital, deep tech and social impact. It has €450m under management and 65 startups in its portfolio.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

Enlightened Hospitality Investments (EHI)

Enlightened Hospitality Investments (EHI) is a New York-based growth fund launched by Danny Meyer and his Union Square Hospitality Group (USHG). The fund leverages USHG's network of chefs, IT, marketers, and industry experts.Active since the early ’90s, it currently has $220m under management. To date, EHI has made eight investments bringing technology into the hospitality sector through companies operating in the food and beverage space.

Enlightened Hospitality Investments (EHI) is a New York-based growth fund launched by Danny Meyer and his Union Square Hospitality Group (USHG). The fund leverages USHG's network of chefs, IT, marketers, and industry experts.Active since the early ’90s, it currently has $220m under management. To date, EHI has made eight investments bringing technology into the hospitality sector through companies operating in the food and beverage space.

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

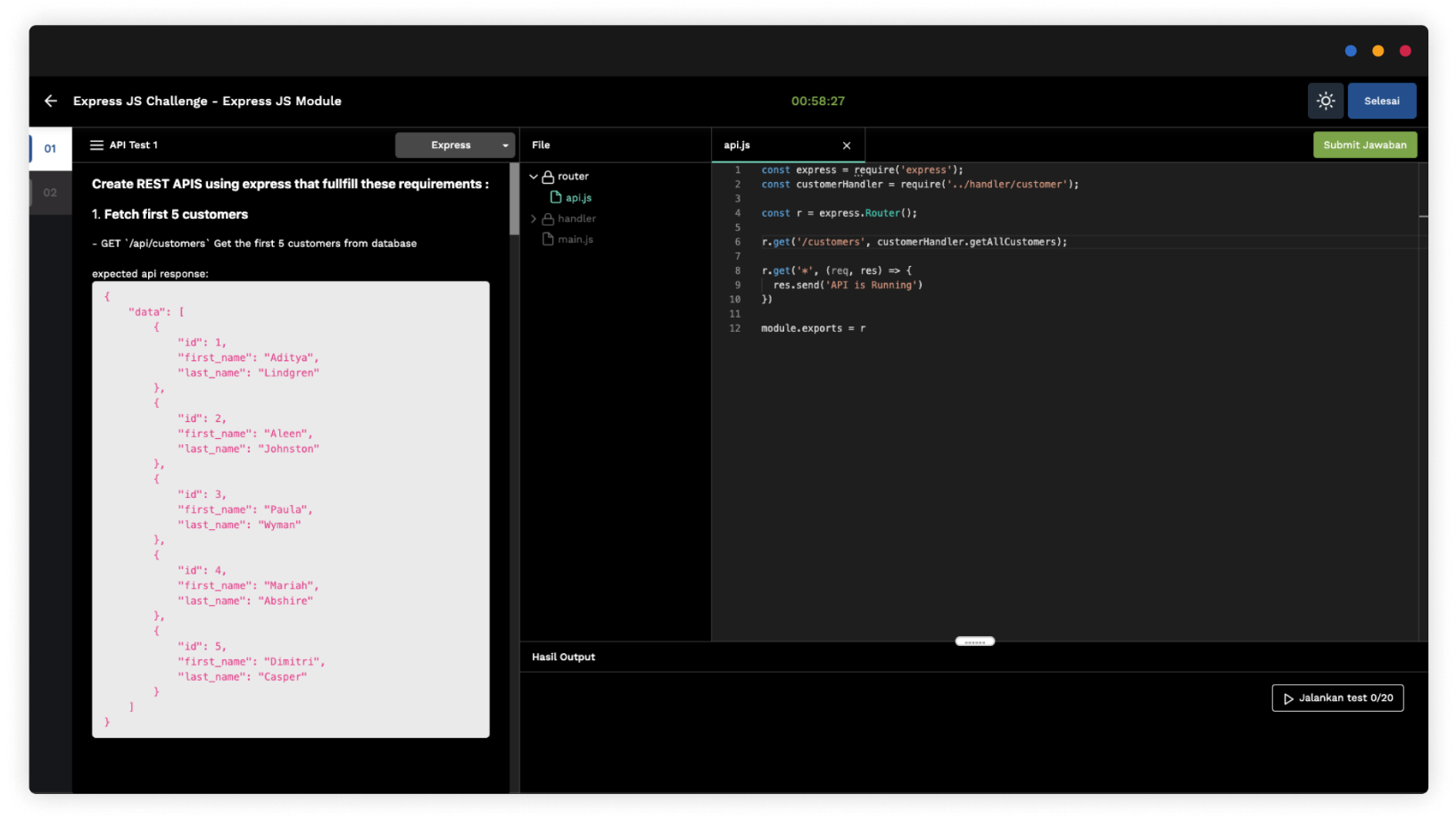

Algobash: SaaS for more effective IT hiring in Indonesia

With its remote assessment and automated interview platform, Algobash seeks faster, fairer and more inclusive recruitment and training of coders, to support tech growth in Indonesia

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

South Summit 2021: Key insights on going from startup to scaleup in Spain

Company culture, talent acquisition and ecosystem support are top-of-mind for Voicemod’s Jaime Bosch and Jobandtalent’s Juan Urdiales in scaling startups up from zero to hero

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Aimentia: Pioneering mental health AI SaaS seeks to improve diagnosis as demand surges

Barcelona-based Aimentia supports the oft-overlooked mental health segment through digitalization and analytics, going beyond therapy platforms

Zoundream: Deciphering and mining the data in baby cries

The world’s first algorithm to translate baby cries into actionable insights for parents and hospitals seeks to boost early detection of pathologies and developmental disorders

Nuuk, the cooler box poised to disrupt cold chain logistics

Barcelona-based startup Groenlandia Tech has developed a smart cooler box to track and monitor biological samples, providing an extra layer of security and control during transport

Future Food Asia 2021: Agrifood tech at an inflection point

Agrifood tech startups urged to harness consumer, investor and government feedback to create plentiful, nutritious food through sustainable means, but exercise caution when considering IPOs

Search instead for portugal, b2b, hospitality